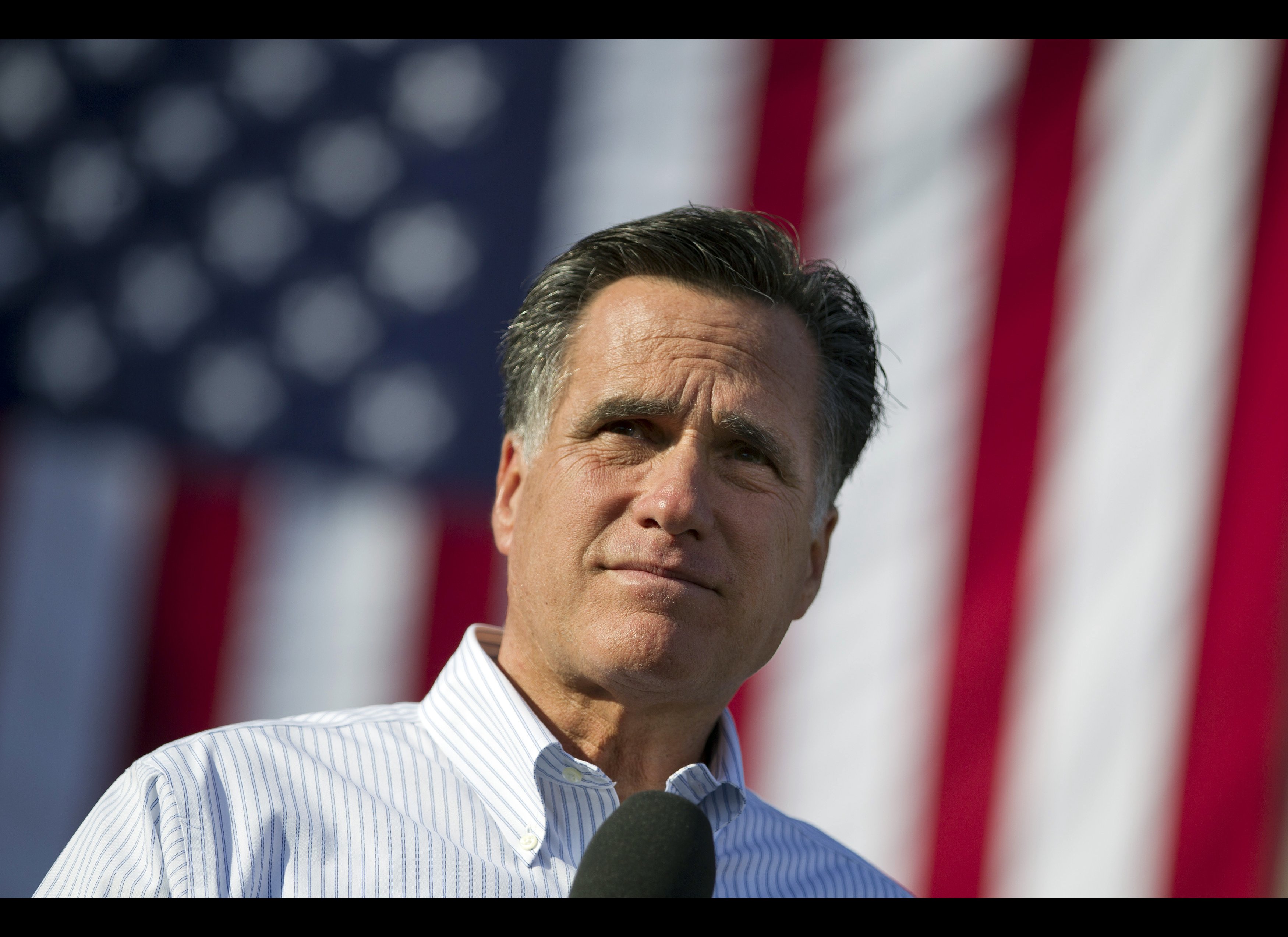

Awakening Wednesday: Mitt Romney, the Buddha, and the 47 Percent

On September 17 Mother Jones released secret video taken at a Romney fundraiser. In one of the most widely-publicized quotes from the video, Romney discusses the 47 percent of Americans who, either through deductions or low income, pay no income taxes:

There are 47 percent of the people who will vote for the president no matter what. All right, there are 47 percent who are with him, who are dependent upon government, who believe that they are victims, who believe the government has a responsibility to care for them, who believe that they are entitled to health care, to food, to housing, to you-name-it. That, that's an entitlement. And the government should give it to them. And they will vote for this president no matter what . . . . These are people who pay no income tax.

The idea that those who fall below the taxable income ought to be paying income taxes has gained increasing traction in conservative circles lately. It's grounded in the idea that poor people are leeches on society—that they take from the hard-working, creative, and responsible upper classes without contributing anything themselves. And that's an idea that's gained more and more currency in both political parties since the Reagan Administration. (Think of Clinton campaigning for welfare reform on the spectre of welfare queens or Obama fretting that mortgage adjustments might go to the undeserving.)There are a lot of discussions of wealth, poverty, and taxation in traditional Buddhist teachings, including some from the Buddha himself, that speak directly to this issue. Here's one I especially like. It's from Commentary on the Way of a King by Jamgön Mipham Gyatso (1846 - 1912), as translated by Lauran Hartley at Columbia University:

If one doesn't collect taxes that are reasonable,and doesn't take equally from the rich and pooraccording to their situation, is that just?From all subjects who pay taxestake in accord with their land,the season, and their wealth, without harming their home.Do not burden them unbearably;Like a cow eating grass,one shouldn't destroy the roots.

To me, Mipham's basic principles seem like a sound foundation for tax policy: (1) People should be taxed in accordance with their income; (2) taxes should be taken from surplus income, not from the money that people need to survive, and they shouldn't harm their ability to make a living or discourage capital investments; and (3) taxes should take outside circumstances and variables into account.Mipham still leaves a lot of room to quibble about the details, but I think he lays out some solid principles to help point us in the right direction. And he clearly refutes the narrative that the poor are simply leeches who need to start paying their fair share.Coming from Georgia, I know better than to graze cattle in a pasture that's struggling; you've got to give the grass the right conditions to grow first. Let's start talking about how to grow that grass higher instead to how to chop it down before it's had a chance.